The Basic Principles Of Pacific Prime

The Basic Principles Of Pacific Prime

Blog Article

The Buzz on Pacific Prime

Table of ContentsThe Greatest Guide To Pacific PrimeGetting The Pacific Prime To WorkAn Unbiased View of Pacific PrimeNot known Factual Statements About Pacific Prime Not known Details About Pacific Prime

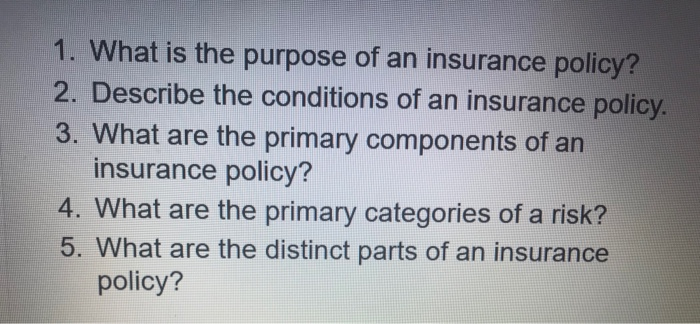

Insurance policy is an agreement, stood for by a policy, in which an insurance holder receives monetary protection or reimbursement versus losses from an insurer. The company pools customers' threats to make repayments much more affordable for the insured. The majority of people have some insurance: for their cars and truck, their home, their health care, or their life.Insurance policy also aids cover expenses linked with liability (legal responsibility) for damages or injury caused to a 3rd celebration. Insurance coverage is a contract (plan) in which an insurer compensates another against losses from certain backups or risks.

Investopedia/ Daniel Fishel Several insurance coverage plan kinds are available, and basically any type of individual or business can discover an insurance policy business willing to insure themfor a cost. Many people in the United States have at least one of these kinds of insurance coverage, and car insurance coverage is called for by state regulation.

Little Known Questions About Pacific Prime.

Locating the price that is best for you calls for some legwork. The plan limit is the optimum amount an insurance company will spend for a protected loss under a plan. Optimums may be established per period (e.g., annual or plan term), per loss or injury, or over the life of the policy, additionally referred to as the lifetime optimum.

Plans with high deductibles are usually cheaper due to the fact that the high out-of-pocket cost usually leads to fewer tiny claims. There are several kinds of insurance coverage. Allow's take a look at the most vital. Medical insurance assists covers regular and emergency situation clinical care costs, frequently with the choice to add vision and oral solutions individually.

Nevertheless, several preventative solutions might be covered for totally free prior to these are met. Medical insurance might be bought from an insurance provider, an insurance agent, the government Medical insurance Industry, supplied by an employer, or federal Medicare and Medicaid insurance coverage. The federal government no longer needs Americans to have health insurance, however in some states, such as California, you may pay a tax charge if you do not have insurance policy.

The Greatest Guide To Pacific Prime

Rather than paying out of pocket for auto accidents and damages, individuals pay yearly premiums to a vehicle insurance provider. The firm then pays all or the majority of the protected costs connected with a vehicle crash or other lorry damage. If you have actually a rented automobile or borrowed money to get a cars and truck, your loan provider or renting car dealership will likely require you to carry auto insurance coverage.

A life insurance coverage plan assurances that the insurance company pays a sum of money to your beneficiaries (such as a partner or children) if you pass away. In exchange, you pay costs during your life time. There are two main kinds of life insurance coverage. Term life insurance policy covers you for a certain period, such as 10 to twenty years.

Insurance policy is a method to handle your financial dangers. When you purchase insurance policy, you acquire defense against unanticipated economic losses. The insurance policy firm pays you or someone you select if something negative takes place. If you have no insurance policy and a crash happens, you might be in charge of all associated expenses.

The Only Guide for Pacific Prime

Although there are numerous insurance plan kinds, several of one of the most typical are life, health, homeowners, and car. The right kind of insurance coverage for you will depend on your goals and monetary circumstance.

Have you ever before had a minute while looking at your insurance policy or buying for insurance coverage when you've thought, "What is insurance? Insurance can be a strange and puzzling point. Exactly how does insurance coverage work?

Nobody wants something bad to happen to them. Yet suffering a loss without insurance can place you in a hard financial situation. Insurance policy is an important financial tool. It can assist you live life with less fears knowing you'll obtain monetary assistance after a disaster or crash, assisting you recover faster.

Pacific Prime Things To Know Before You Get This

And in some cases, like automobile insurance policy and employees' settlement, you may be needed by law to have look at more info insurance policy in order to shield others - international health insurance. Learn concerning ourInsurance options Insurance is basically an enormous nest egg shared by many individuals (called policyholders) and handled by an insurance provider. The insurance provider uses cash gathered (called costs) from its insurance holders and other investments to pay for its procedures and to fulfill its pledge to insurance policy holders when they file an insurance claim

Report this page